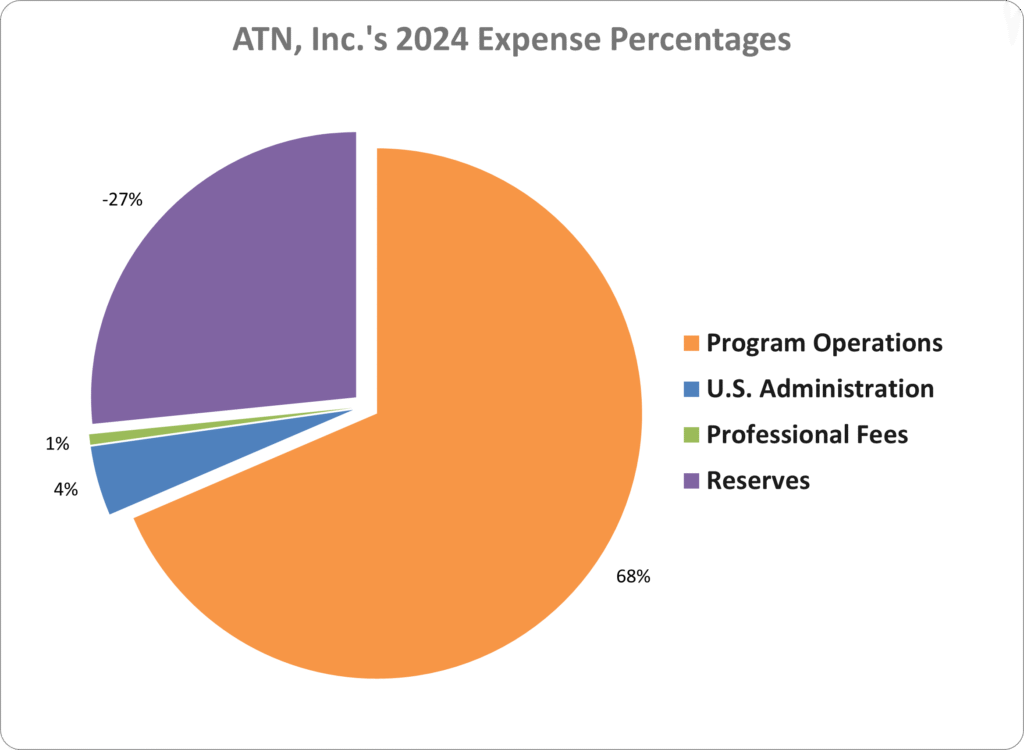

2024

In Fiscal Year ending December 31, 2024, total donated income was $119,052.

$173,350 was designated to Program Operations, $10,703 to U.S. Administrative costs, $1,591 to Professional Fees, and $67,262 was taken from Reserves.*

*From an independent audit by SOMMERVILLE & ASSOCIATES, P.C.

Please contact us to request a Public Inspection Copy of ATN, Inc’s 2024 IRS Form 990.

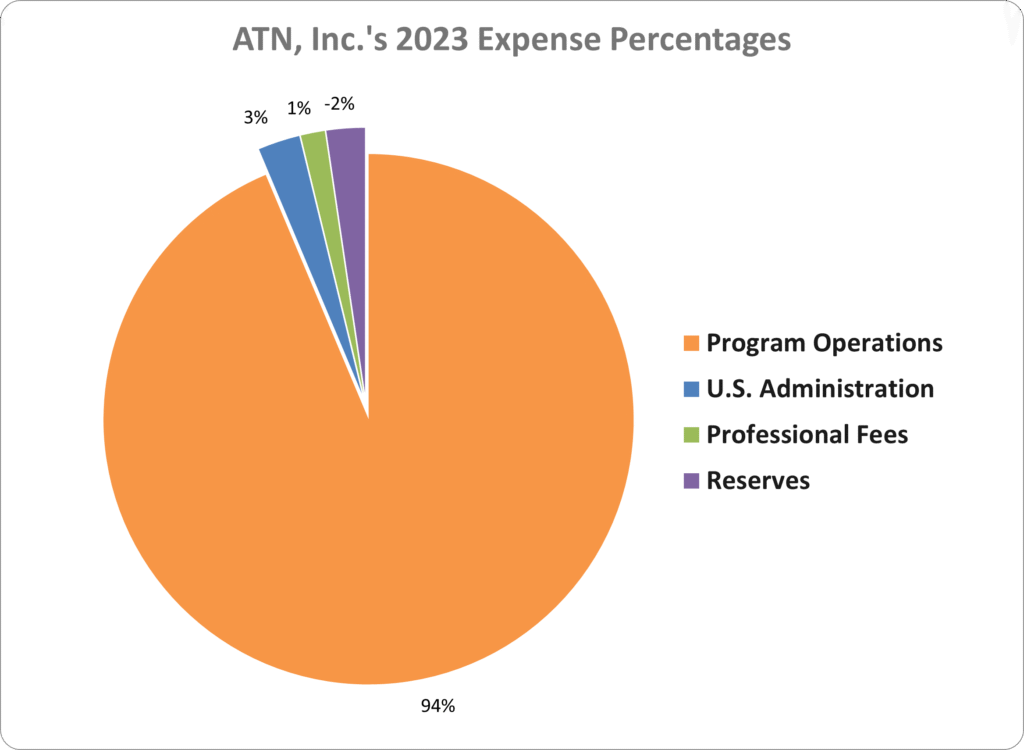

2023

In Fiscal Year ending December 31, 2023, total donated income was $172,952.

$170,527 was designated to Program Operations, $4,645 to U.S. Administrative costs, $2,660 to Professional Fees, and $4,247 was taken from Reserves.*

*From an independent audit by SOMMERVILLE & ASSOCIATES, P.C.

In Fiscal Year ending December 31, 2023, total donated income was $172,952.

$170,527 was designated to Program Operations, $4,645 to U.S. Administrative costs, $2,660 to Professional Fees, and $4,247 was taken from Reserves.*

*From an independent audit by SOMMERVILLE & ASSOCIATES, P.C.

Please contact us to request a Public Inspection Copy of ATN, Inc’s 2024 IRS Form 990.

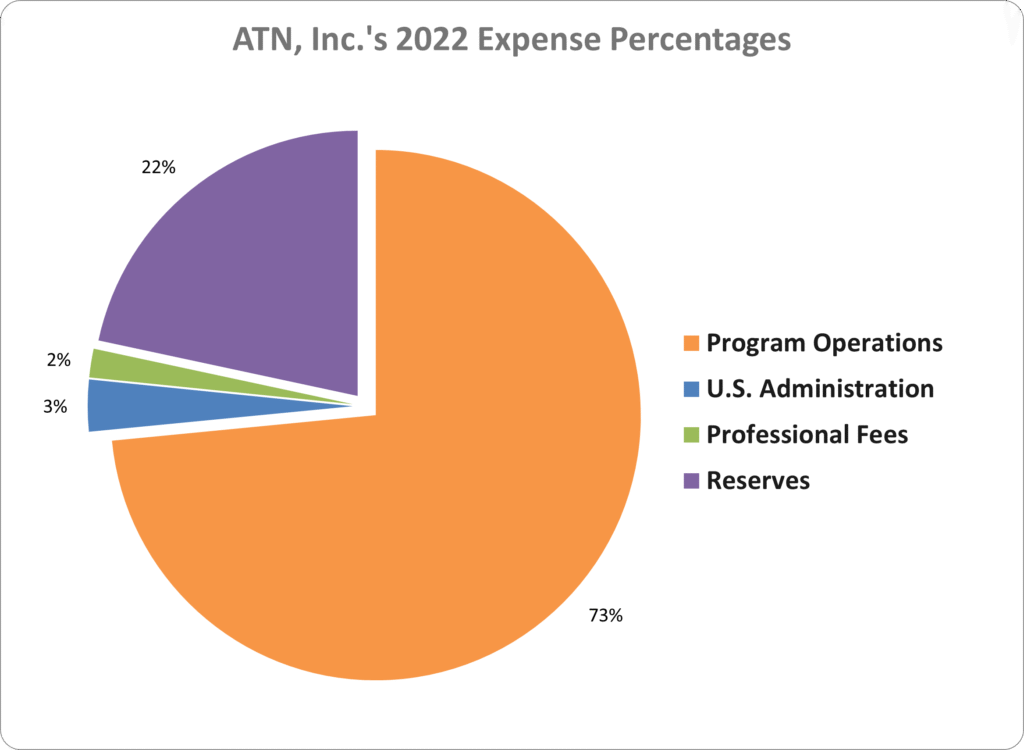

2022

In Fiscal Year ending December 31, 2022, total donated income was $188,566.

$138,525 was designated to Program Operations, $5,935 to U.S. Administrative costs, $3,292 to Professional Fees, and $40,811 remained in Reserves.*

*From an independent audit by SOMMERVILLE & ASSOCIATES, P.C.

In Fiscal Year ending December 31, 2023, total donated income was $172,952.

$170,527 was designated to Program Operations, $4,645 to U.S. Administrative costs, $2,660 to Professional Fees, and $4,247 was taken from Reserves.*

*From an independent audit by SOMMERVILLE & ASSOCIATES, P.C.

Please contact us to request a Public Inspection Copy of ATN, Inc’s 2024 IRS Form 990.

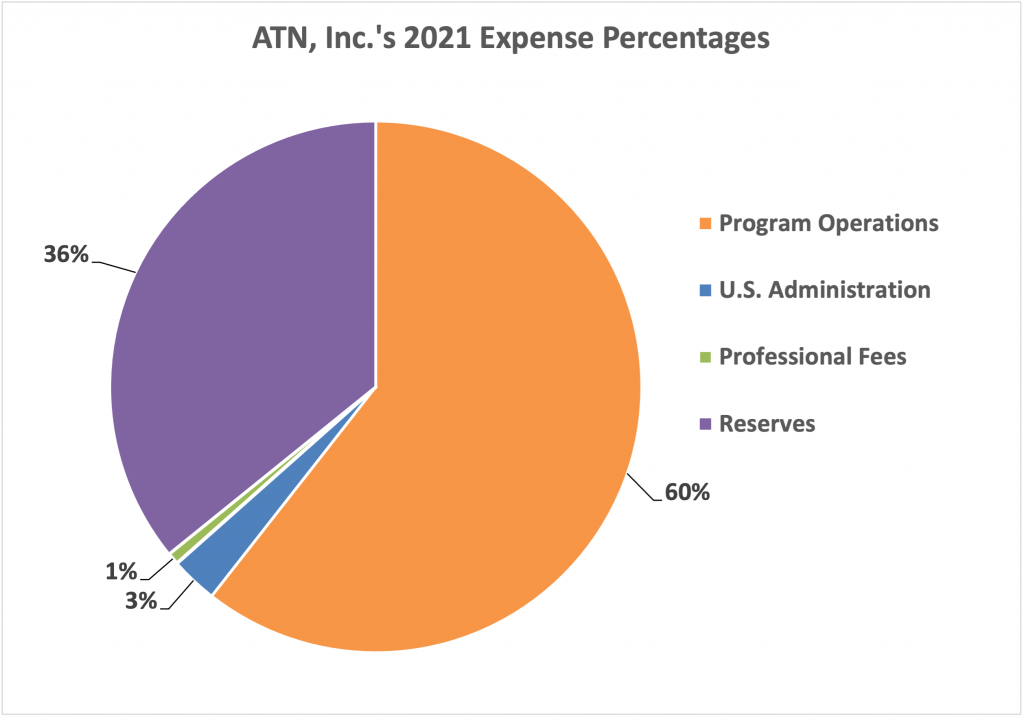

2021

In Fiscal Year ending December 31, 2021, total donated income was $237,244.

$144,050 was designated to Program Operations, $6,801 to U.S. Administrative costs, $1,750 to Professional Fees, and $85,182 remained in Reserves.*

*From an independent audit by SOMMERVILLE & ASSOCIATES, P.C.

Please contact us to request a Public Inspection Copy of ATN, Inc’s 2024 IRS Form 990.

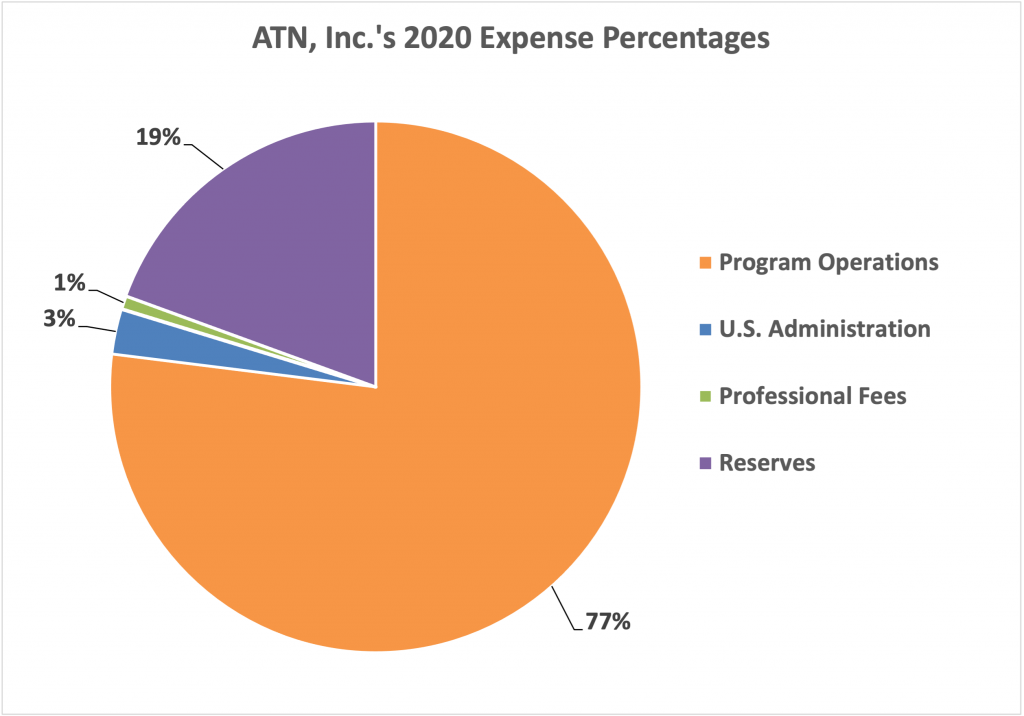

2020

In Fiscal Year ending December 31, 2020, total donated income was $209,915.

$161,629 was designated to Program Operations, $5,782 to U.S. Administrative costs, $1,750 to Professional Fees, and $40,807 remained in Reserves.*

*From an independent audit by SOMMERVILLE & ASSOCIATES, P.C.

Please contact us to request a Public Inspection Copy of ATN, Inc’s 2024 IRS Form 990.

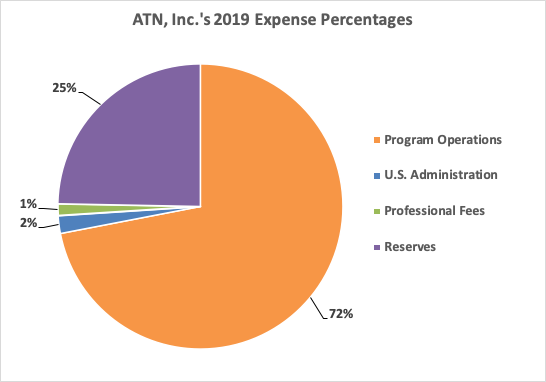

2019

In Fiscal Year ending December 31, 2019, total donated income was $229,850.

$165,404 was designated to Program Operations, $4,624 to U.S. Administrative costs, $3,065 to Professional Fees, and $56,757 remained in Reserves.*

*From an independent audit by SOMMERVILLE & ASSOCIATES, P.C.

Please contact us to request a Public Inspection Copy of ATN, Inc’s 2024 IRS Form 990.

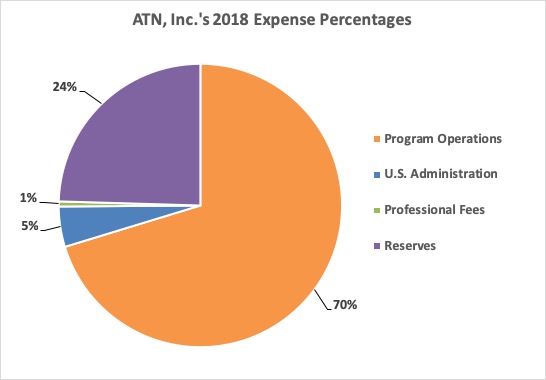

2018

In Fiscal Year ending December 31, 2018, total donated income was $216,327.

$152,045 was designated to Program Operations, $9,951 to U.S. Administrative costs, $1,250 to Professional Fees, and $53,081 remained in Reserves.*

*From an independent audit by SOMMERVILLE & ASSOCIATES, P.C.

Please contact us to request a Public Inspection Copy of ATN, Inc’s 2024 IRS Form 990.

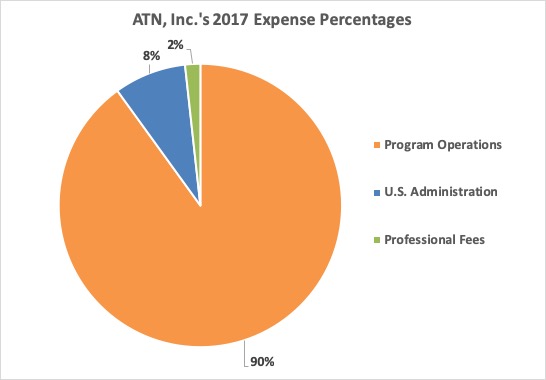

2017

In Fiscal Year ending December 31, 2017, total donated income was $145,595 and $2,069 was taken from Reserves.

$132,946 was designated to Program Operations, $12,156 to U.S. Administrative costs, and $2,562 to Professional Fees.*

*From an independent audit by SOMMERVILLE & ASSOCIATES, P.C.

Please contact us to request a Public Inspection Copy of ATN, Inc’s 2024 IRS Form 990.

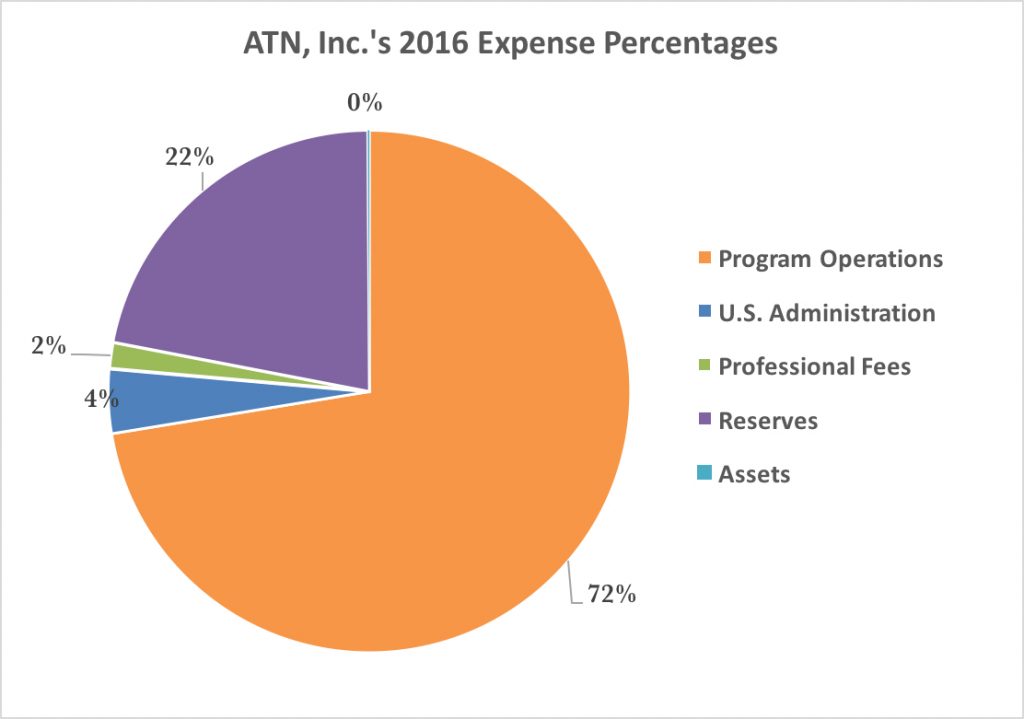

2016

In Fiscal Year ending December 31, 2016, total donated income was $183,296.

$132,866 was designated to Program Operations, $7,315 to U.S. Administrative costs, $2,993 to Professional Fees, $187 to Assets, and $40,124 remained in Reserves.*

*From an independent audit by SOMMERVILLE & ASSOCIATES, P.C.

Please contact us to request a Public Inspection Copy of ATN, Inc’s 2024 IRS Form 990.

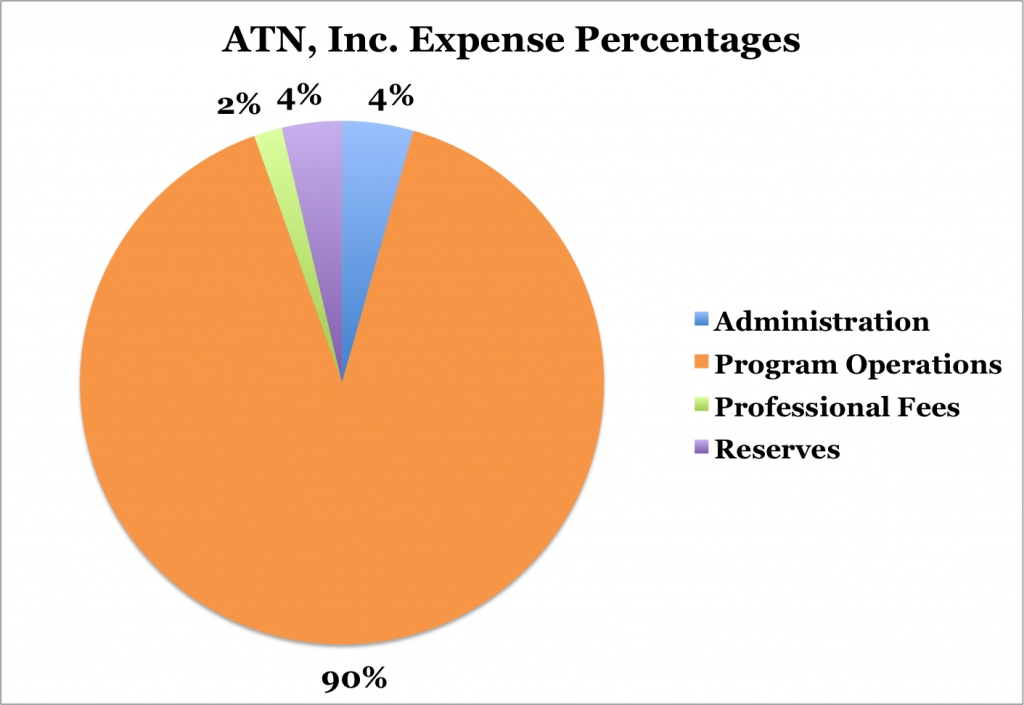

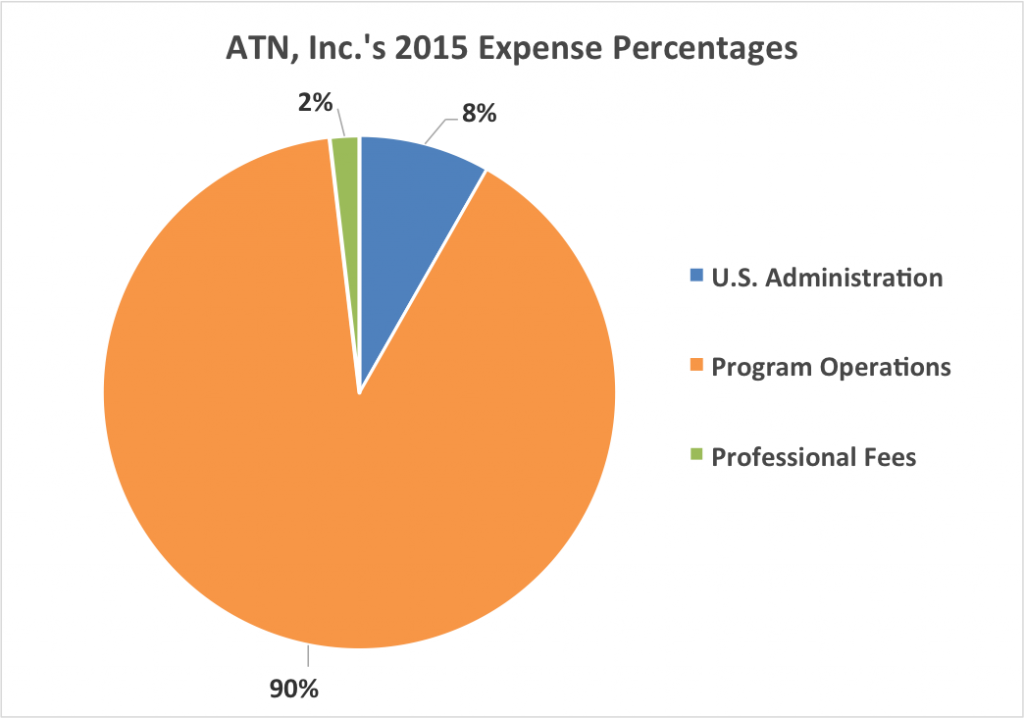

2015

In Fiscal Year ending December 31, 2015, total donated income was $113,903 and $23,405 was taken from Reserves.

$123,426 was designated to Program Operations, $11,322 to Administrative costs, and $2,560 to Professional Fees.*

*From an independent audit by SOMMERVILLE & ASSOCIATES, P.C.

Please contact us to request a Public Inspection Copy of ATN, Inc’s 2024 IRS Form 990.

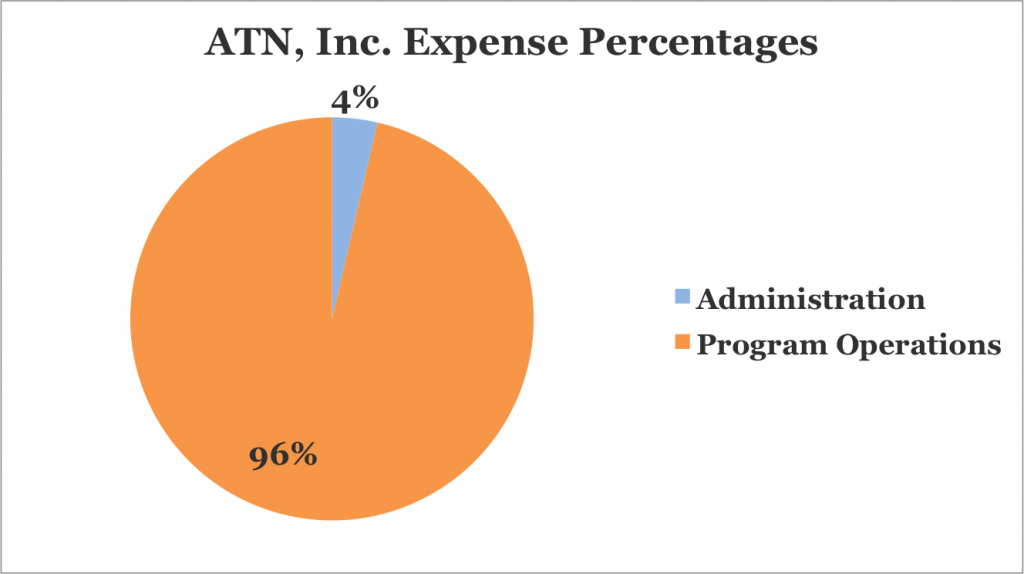

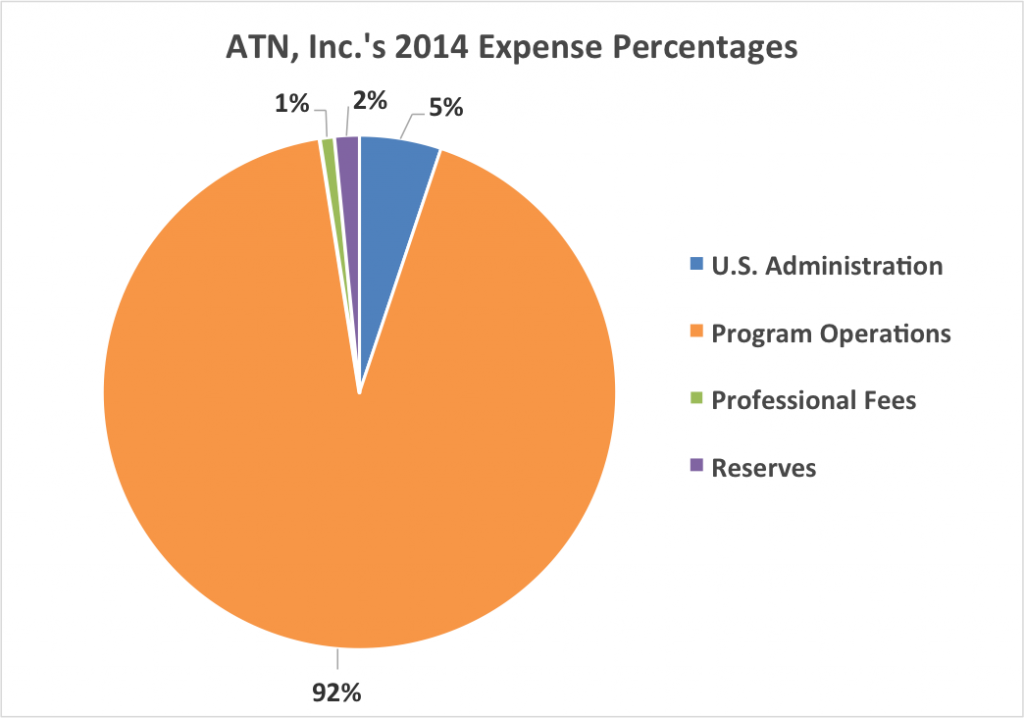

2014

In Fiscal Year ending December 31, 2014, total donated income was $153,686.

$141,960 was designated to Program Operations, $2,382 was added to Reserves; $7,904 to Administrative costs, and $1,440 to Professional Fees.*

*From an independent audit by SOMMERVILLE & ASSOCIATES, P.C.

Please contact us to request a Public Inspection Copy of ATN, Inc’s 2024 IRS Form 990.

2013

In Fiscal Year ending December 31, 2013, total donated income was $191,012.

$172,056 was designated to Program Operations, $7,050 was put in Reserves; $8,572 to Administrative costs, and $3,334 to Professional Fees.*

*From an independent audit by SOMMERVILLE & ASSOCIATES, P.C.

Please contact us to request a Public Inspection Copy of ATN, Inc’s 2024 IRS Form 990.

2012

In Fiscal Year ending December 31, 2012, total donated income was $321,570.11.

$309,890.40 was designated to program operations and reserves and $11,679.71 to administrative costs.*

*From an independent audit by SOMMERVILLE & ASSOCIATES, P.C.

Please contact us to request a Public Inspection Copy of ATN, Inc’s 2024 IRS Form 990.