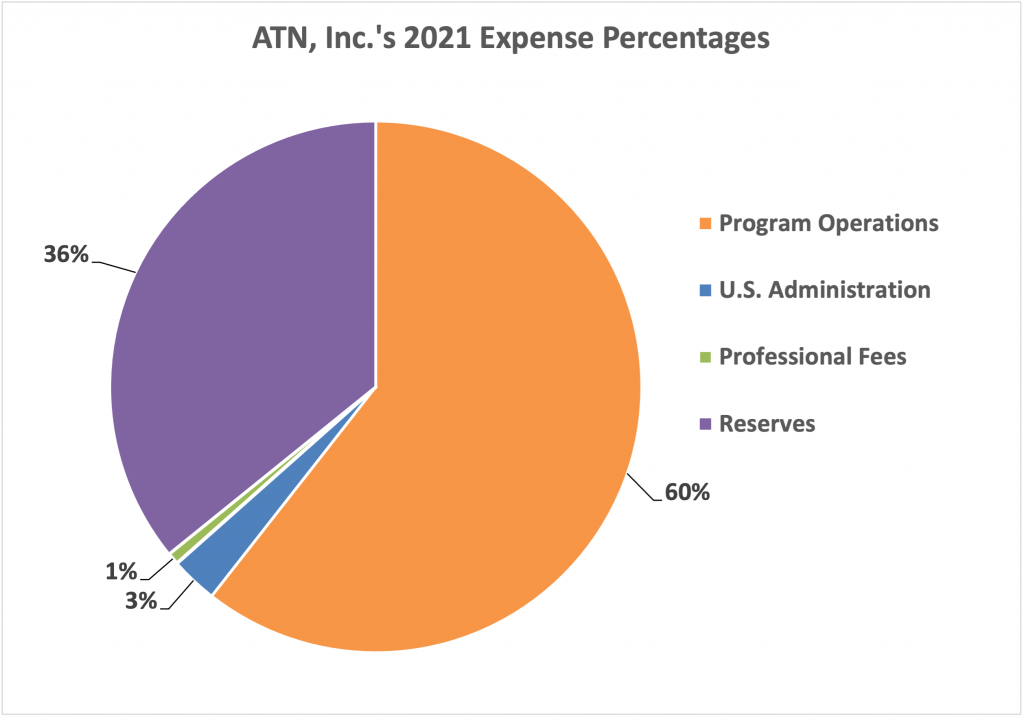

2021

In Fiscal Year ending December 31, 2021, total donated income was $237,244.

$144,050 was designated to Program Operations, $6,801 to U.S. Administrative costs, $1,750 to Professional Fees, and $85,182 remained in Reserves.*

*From an independent audit by SOMMERVILLE & ASSOCIATES, P.C.

Please contact us if you would like to see the Public Inspection Copy of ATN, Inc’s 2021 IRS Form 990.

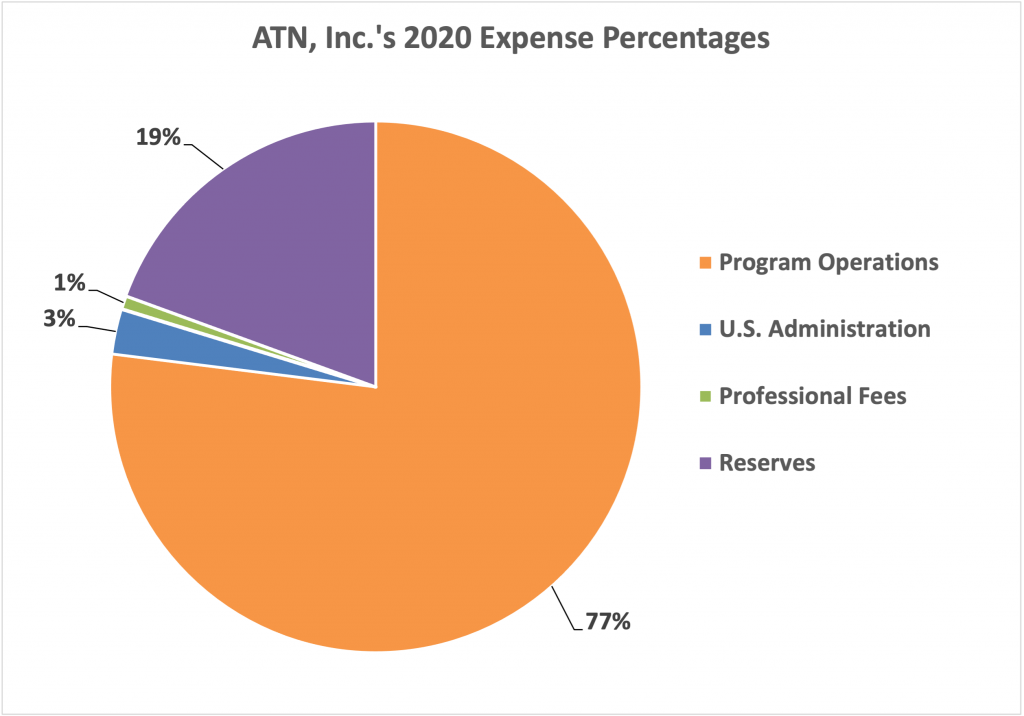

2020

In Fiscal Year ending December 31, 2020, total donated income was $209,915.

$161,629 was designated to Program Operations, $5,782 to U.S. Administrative costs, $1,750 to Professional Fees, and $40,807 remained in Reserves.*

*From an independent audit by SOMMERVILLE & ASSOCIATES, P.C.

Please contact us if you would like to see the Public Inspection Copy of ATN, Inc’s 2020 IRS Form 990.

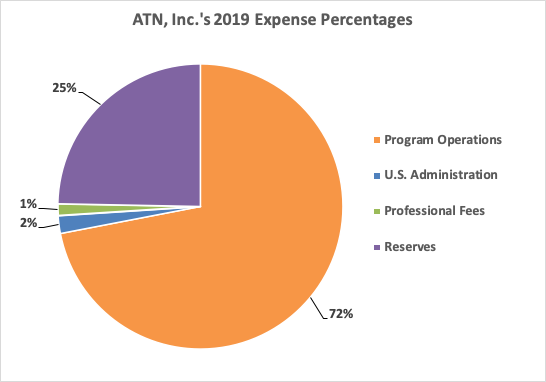

2019

In Fiscal Year ending December 31, 2019, total donated income was $229,850.

$165,404 was designated to Program Operations, $4,624 to U.S. Administrative costs, $3,065 to Professional Fees, and $56,757 remained in Reserves.*

*From an independent audit by SOMMERVILLE & ASSOCIATES, P.C.

Please contact us if you would like to see the Public Inspection Copy of ATN, Inc’s 2019 IRS Form 990.

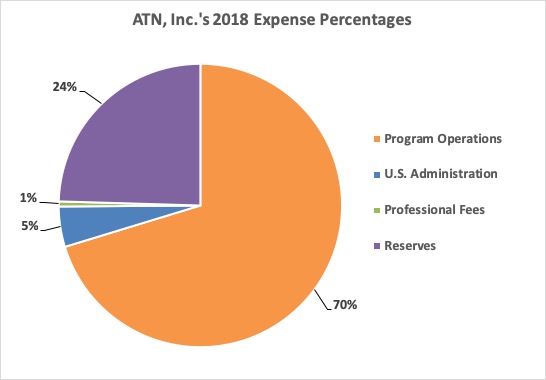

2018

In Fiscal Year ending December 31, 2018, total donated income was $216,327.

$152,045 was designated to Program Operations, $9,951 to U.S. Administrative costs, $1,250 to Professional Fees, and $53,081 remained in Reserves.*

*From an independent audit by SOMMERVILLE & ASSOCIATES, P.C.

Please contact us if you would like to see the Public Inspection Copy of ATN, Inc’s 2018 IRS Form 990.

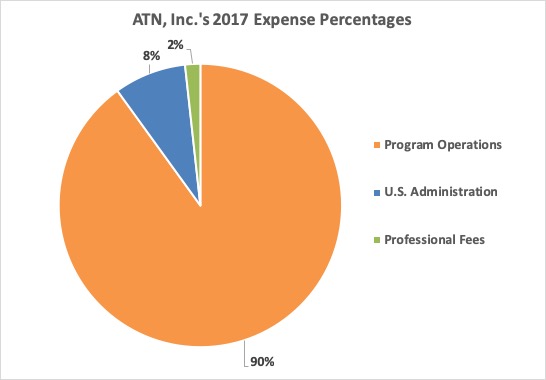

2017

In Fiscal Year ending December 31, 2017, total donated income was $145,595 and $2,069 was taken from Reserves.

$132,946 was designated to Program Operations, $12,156 to U.S. Administrative costs, and $2,562 to Professional Fees.*

*From an independent audit by SOMMERVILLE & ASSOCIATES, P.C.

Please contact us if you would like to see the Public Inspection Copy of ATN, Inc’s 2017 IRS Form 990.

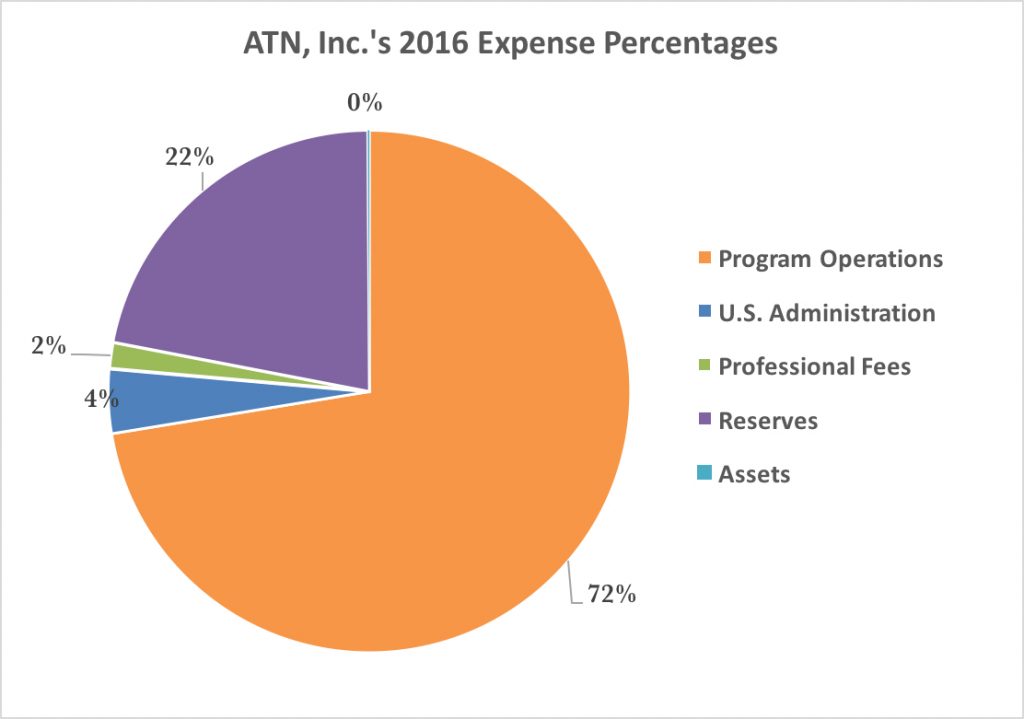

2016

In Fiscal Year ending December 31, 2016, total donated income was $183,296.

$132,866 was designated to Program Operations, $7,315 to U.S. Administrative costs, $2,993 to Professional Fees, $187 to Assets, and $40,124 remained in Reserves.*

*From an independent audit by SOMMERVILLE & ASSOCIATES, P.C.

Please contact us if you would like to see the Public Inspection Copy of ATN, Inc’s 2016 IRS Form 990.

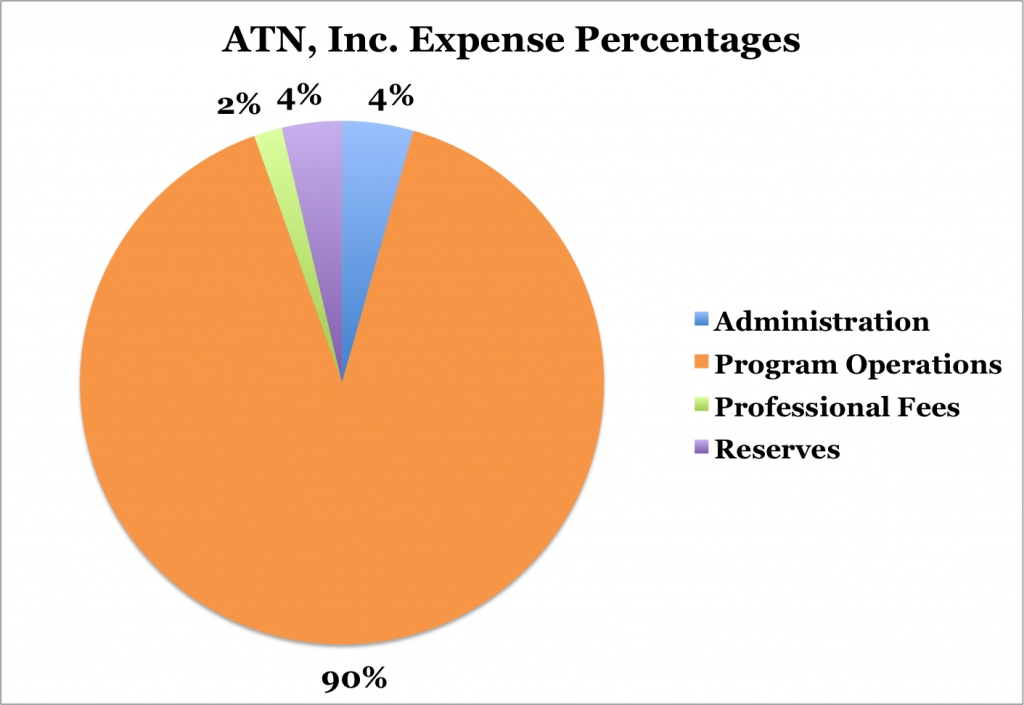

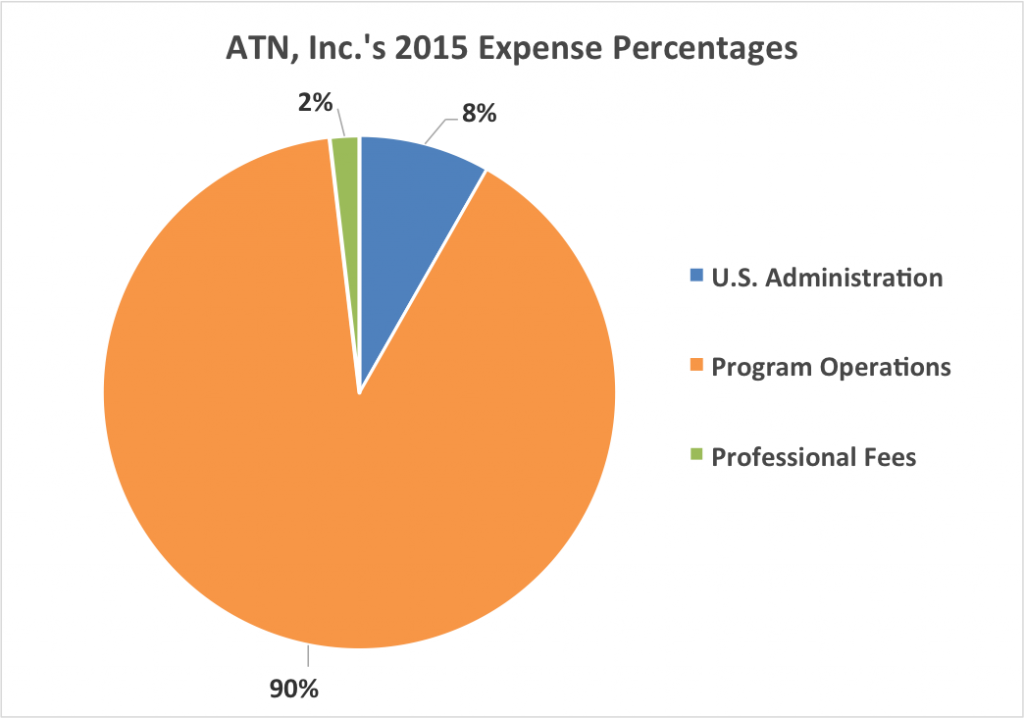

2015

In Fiscal Year ending December 31, 2015, total donated income was $113,903 and $23,405 was taken from Reserves.

$123,426 was designated to Program Operations, $11,322 to Administrative costs, and $2,560 to Professional Fees.*

*From an independent audit by SOMMERVILLE & ASSOCIATES, P.C.

Please contact us if you would like to see the Public Inspection Copy of ATN, Inc’s 2015 IRS Form 990.

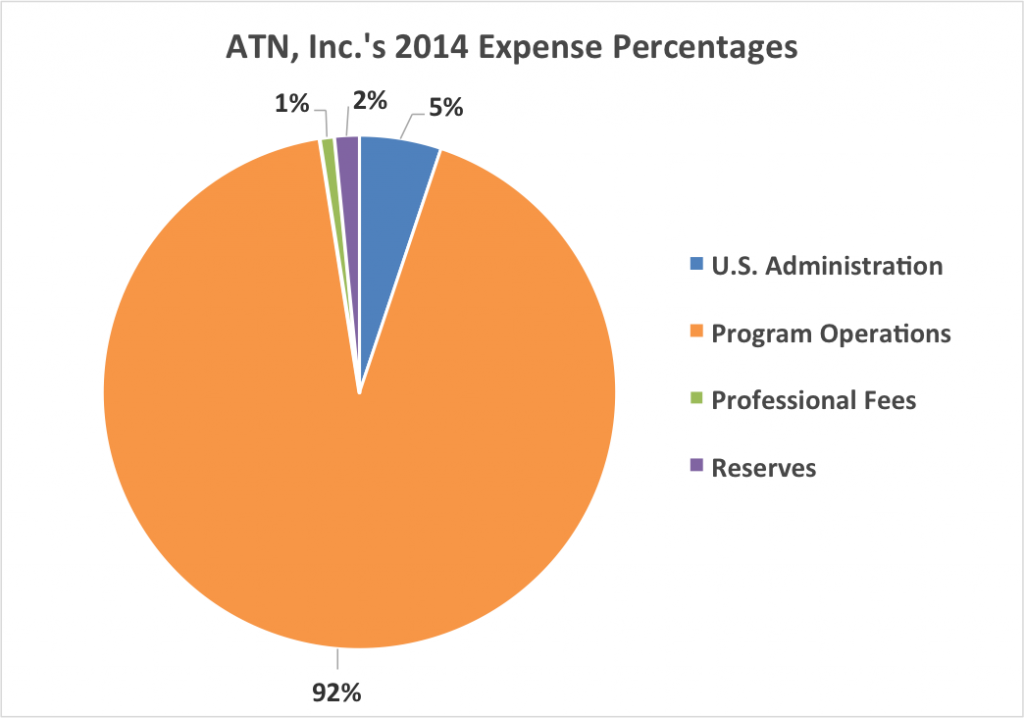

2014

In Fiscal Year ending December 31, 2014, total donated income was $153,686.

$141,960 was designated to Program Operations, $2,382 was added to Reserves; $7,904 to Administrative costs, and $1,440 to Professional Fees.*

*From an independent audit by SOMMERVILLE & ASSOCIATES, P.C.

Please contact us if you would like to see the Public Inspection Copy of ATN, Inc’s 2014 IRS Form 990.

2013

In Fiscal Year ending December 31, 2013, total donated income was $191,012.

$172,056 was designated to Program Operations, $7,050 was put in Reserves; $8,572 to Administrative costs, and $3,334 to Professional Fees.*

*From an independent audit by SOMMERVILLE & ASSOCIATES, P.C.

Please contact us if you would like to see the Public Inspection Copy of ATN, Inc’s 2013 IRS Form 990.

2012

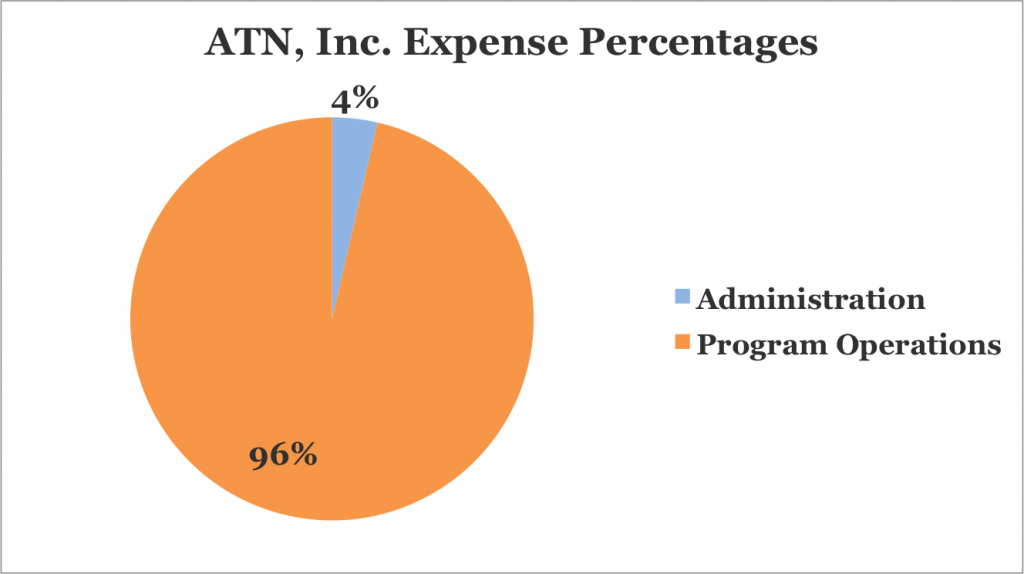

In Fiscal Year ending December 31, 2012, total donated income was $321,570.11.

$309,890.40 was designated to program operations and reserves and $11,679.71 to administrative costs.*

*From an independent audit by SOMMERVILLE & ASSOCIATES, P.C.

Please contact us if you would like to see the Public Inspection Copy of ATN, Inc’s 2012 IRS Form 990.